Customer Data Platform: figures and market trends

5min • Last updated on Feb 27, 2025

Olivier Renard

Content & SEO Manager

In 2013, David Raab, founder and CEO of the CDP Institute, first defined the term Customer Data Platform.

Since then, the CDP market has experienced rapid growth. The gradual phase-out of third-party cookies and the rise of data marketing have made these platforms a strategic tool for businesses.

Key Takeaways:

A fast-growing market: The CDP market is valued at several billion dollars. Reports* confirm that it is expected to grow at an annual rate of over 30% by 2030 across all regions.

A key business driver: CDPs enable companies to collect, unify, and activate customer data to enhance personalisation and marketing performance. Adoption is increasing across sectors such as retail, finance, and tourism.

Major trends in 2025: The rise of composable CDPs, AI integration, and the gradual disappearance of third-party cookies is transforming the market.

Leading players: Salesforce, Hightouch, Treasure Data, Segment, DinMo, and new entrants are shaping the industry’s future.

🔍 What will be the size of the CDP market in 2025? Who are the dominant players, and what trends should you watch? Discover key figures and major market developments. 📈

Customer Data Platform: definition and concept

A Customer Data Platform (CDP) is a solution that collects, organises, and activates customer data. Unlike traditional tools such as CRMs, it unifies data from multiple sources (web, mobile, email, in-store, etc.) to create a single, actionable customer profile.

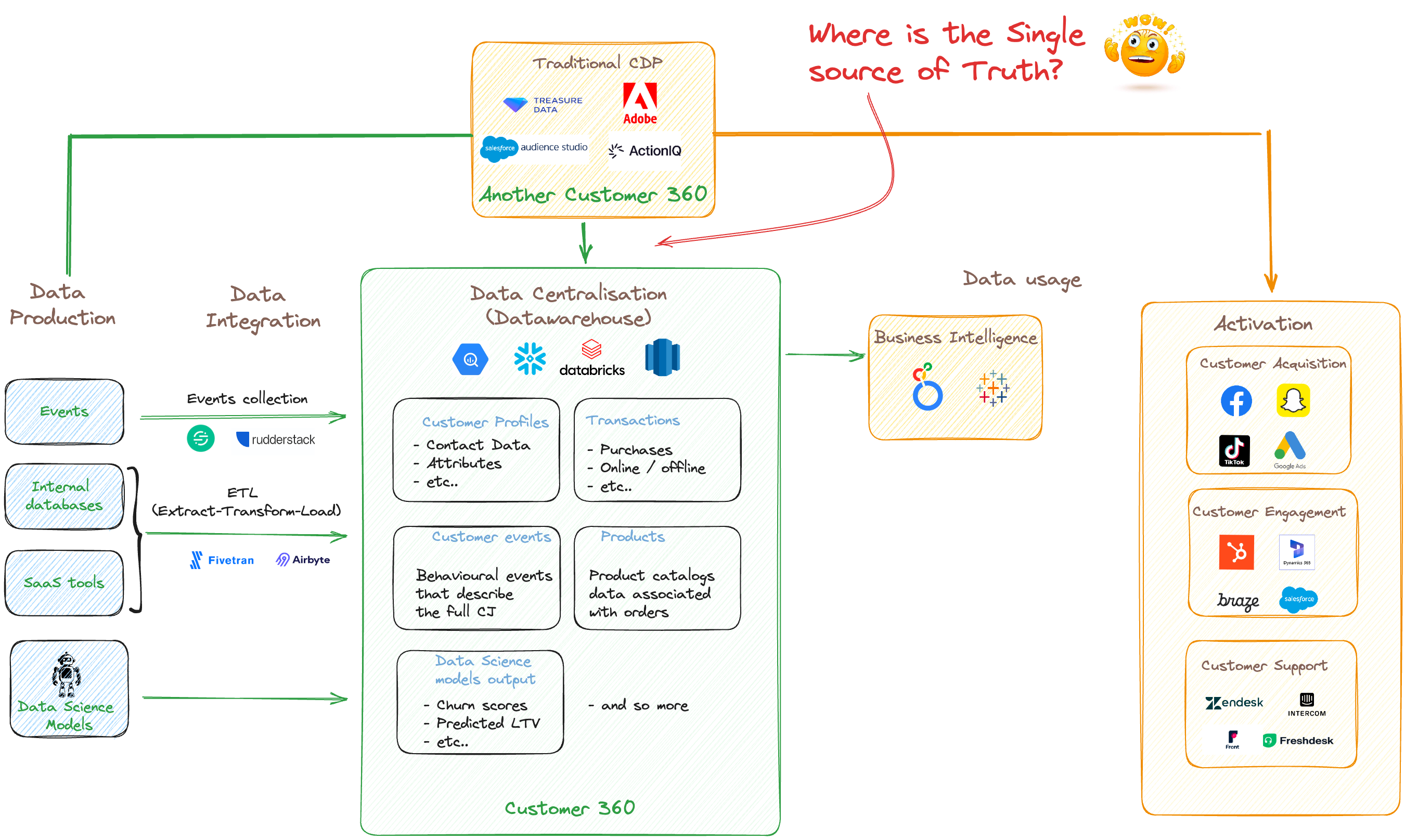

A distinction is made between packaged, or traditional CDPs, and composable CDPs. Packaged CDPs are integrated solutions that collect, store and activate data from a single tool. Composable CDPs, on the other hand, are based directly on the company's data warehouse, so there is no need to duplicate data. They offer greater control and are quicker to implement.

Traditional CDPs duplicate data, negating the concept of "Single Source of Truth"

Businesses are increasingly adopting CDPs to optimise marketing campaigns, personalise customer experiences, and improve performance. With the end of third-party cookies and the rise of data marketing, CDPs have become an essential strategic tool.

👉 Now, let’s dive into the key market figures for CDPs! 📊

CDP market size and growth in 2025

Global Revenue

The latest report from the CDP Institute (CDPI) puts the global market at $2.4 billion for 2024. This figure is probably underestimated, since it is based solely on sales by packaged CDP suppliers.

MarketsandMarkets was already reporting a figure of $5.1 billion for 2023, and Data Bridge Market Research $6.24 billion for the same year.

Market growth

All studies agree: the Customer Data Platform market is expanding rapidly. The CDPI reports an average annual growth rate (CAGR) of nearly 17% between 2020 and 2024.

Between 2024 and 2030, forecasts are even more optimistic, ranging from 24.4% (Fortune Business Insights) to 39.9% (MarketsandMarkets).

CDPI also notes a 23% increase in investments compared to the previous year. The sector’s workforce grew by 9% in 2024 alone.

Key growth factors

The rapid rise of CDPs is driven by several factors:

The increasing importance of first-party data due to the decline of third-party cookies and regulatory changes (GDPR, CCPA).

The expansion of cloud-based solutions and the need for centralised data management.

The adoption of AI and machine learning technologies for better segmentation and personalisation

Growth in e-commerce and the rise of data-driven marketing.

Omnichannel integration and personalised customer experiences.

Market distribution

By Region

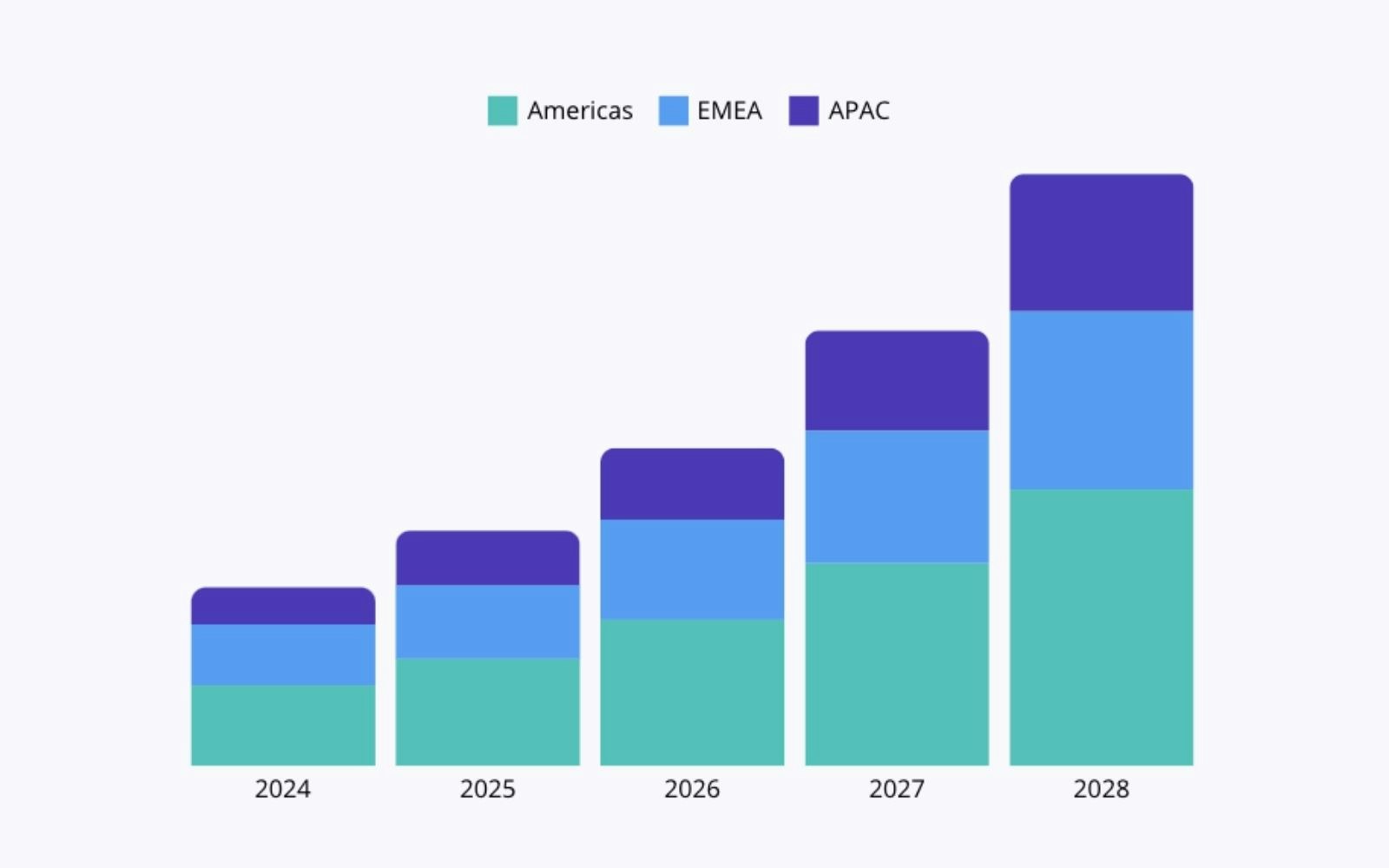

Market shares vary slightly depending on the study. According to Polaris, regional distribution is projected as follows:

CDP market by area

The share of the American market (North America and Latin America combined) exceeds 45% overall. The Europe Middle East and Africa region accounts for around 32%, while the Asia-Pacific (APAC) region accounts for 23% of the global market.

These figures are broadly in line with the geographical breakdown of publishers by origin (Statista):

Americas = 48%

EMEA = 34%

APAC = 18%

By industry

The most CDP-adopting industries (Statista / CDPI):

🥇 Retail: Centralise customer data for a seamless omnichannel experience.

Personalise offers and optimise marketing campaigns in real time.

🥈 Finance: Improve regulatory compliance (RGPD, CCPA).

Unify customer data for a better understanding of customer behaviour and advanced segmentation (Industry growth insight).

🥉 Tourism: Delivering tailored experiences based on travellers’ preferences.

Automating data management for better customer retention.

Key market players and trends

Leading CDP providers by category

There are approximately 200 Customer Data Platform providers. Gartner offers a ranking of CDPs based on user ratings.

Meanwhile, the CDP Institute focuses on categorising platforms by functionality:

Data CDP: Collects and centralises customer data to create unified profiles.

Analytics CDP: Adds analytical capabilities such as advanced segmentation, machine learning, and revenue attribution.

Campaign CDP: Integrates marketing orchestration features to personalise messages and interactions with each customer.

Delivery CDP: Manages the entire process, from data collection to message delivery via email, websites, CRM, advertising, or mobile applications.

Our goal is to provide an overview of key market players, not a direct comparison with DinMo. The table below focuses on the different types of customer data platforms available on the market.

CDP type | Definition | Main vendors |

|---|---|---|

Traditional CDPs | All-in-one solutions that collect, unify, and activate customer data within a dedicated platform. | Segment, Treasure Data, mParticle, Lytics |

Composable CDPs | Modular CDPs that rely on the company's data warehouse, offering greater flexibility. | DinMo, Hightouch, Census |

MarTech CDPs | Platforms integrated into global marketing solutions (CRM, automation, analytics). | Salesforce CDP, Adobe Experience Platform, Oracle CDP |

Hybrid CDPs | Intermediate solutions between traditional CDPs and composable approaches. | ActionIQ, Imagino, Simon Data |

Customer Data Infrastructure | Solutions focused on data management at the IT infrastructure level, often used by data teams. | Rudderstack, Metarouter, Oracle GoldenGate, Matillion. |

The main players in the CDP market

A Customer Data Platform is not exclusively for large enterprises. SMEs can also gain significant benefits from a CDP, provided they choose a solution that aligns with their needs and resources.

A composable CDP enables businesses to leverage customer data easily and cost-effectively. It helps deliver personalised experiences, enhance customer loyalty, and optimise marketing campaigns.

Market trends

In 2021, the deployment rate was 26% in the Americas, 21% in Europe and 20% in Asia (CDPI). The strongest growth is currently taking place in these last two zones.

The main reasons for buying a CDP (Segment - 2030, Today) :

1️⃣ Customer experience

2️⃣ Insights and reporting

3️⃣ Customer Privacy

The main obstacles and difficulties to implementation are organisational (cooperation, adoption by teams), budgetary and technical (collection, storage, duplication).

These challenges are prompting companies to turn to composable Customer Data Platforms, which appeared on the market at the turn of the 2020s. By relying on the existing data warehouse, they offer greater flexibility and avoid duplicating data. As a result, they give data teams better governance of their data, while making it easier for marketing teams to activate it.

The functionalities most sought after by buyers (CDPI / Statista) :

1️⃣ A single source of truth

2️⃣ A 360° customer view

3️⃣ Self-service data activation for business teams

CDP market outlook and evolution

Artificial intelligence is enhancing data analytics and activation. It improves data quality, automates processing and facilitates predictive analysis. It enables companies to anticipate customer behaviour and optimise their marketing strategies.

At the same time, no-code functionalities simplify the adoption of CDP by business teams. At DinMo, the Segment builder and calculated fields allow users to create targeted audiences and activate data without any technical skills.

These advancements are making CDPs more accessible and powerful, addressing personalisation and marketing performance challenges.

Conclusion

The Customer Data Platforms market continues to grow, driven by the boom in data marketing and the need to make better use of first-party data. With increasingly stringent regulations and the end of third-party cookies, businesses are having to rethink their approach to data management.

Composable CDPs offer a flexible, cost-effective solution, integrating directly into existing infrastructures. They enable better data control and more efficient activation without unnecessary duplication.

💡 Find out how a composable CDP like DinMo can help you organise and activate your customer data with ease. 🚀

*Main sources: Statista, CDP Institute, Polaris, MarketsandMarkets, Data Bridge Market Research.