Customer scoring: definition, method and examples

6min • Last updated on Feb 17, 2025

Alexandra Augusti

Chief of Staff

Customer scoring is an effective method that aims to evaluate and assign a score to each of your customers. This score is based on well-defined criteria, aligned with the specifics of your business (industry, repeat rate, average basket, subscription, etc.)

The goal of customer scoring is to better understand them in order to better segment your customer data base and offer them personalized marketing actions that match their profile (expectations, LTV, etc.). Thus, customer scoring proves to be an indispensable tool for increasing the return on investment (ROI) of your marketing actions and for strengthening the loyalty of your clientele.

But, how do you give a score to your customers? What benefits and applications does customer scoring offer? How do you use your scorings in customer segmentation?

👉🏼 In this article, we will explore the definition, concrete examples, and methods of customer scoring, as well as best practices for deploying it effectively.

What is customer scoring?

Customer scoring is a process aimed at assigning a specific score to each customer of a company. This score can be used for analytical purposes – such as evaluating the customer lifetime value (CLV, also known as Lifetime Value (LTV)) – or operational purposes, helping to define customer segments and guide marketing strategies.

This technique is based on two fundamental principles:

The diversity of value between customers: for example, let's recall the Pareto principle, which, applied to customer value, would state that 80% of customers only represent 20% of the turnover.

The need to prioritize marketing actions and efficiently allocate the budget: advertisements on social networks, emails, sales efforts, associated promotional codes, etc. All of this has a cost! It is therefore important to know which customers it is really interesting to spend money on to maximize the ROI.

The primary goal of customer scoring is to optimize commercial performance by identifying and targeting customers most likely to make repeat purchases, increase their average basket, return frequently, and be fully satisfied (notably with the aim of increasing the Net Promoter Score [NPS]).

⚠️ It is important not to confuse lead scoring and customer scoring. Lead scoring is only used for acquiring new customers and is mainly useful for sales teams. It aims to evaluate prospects based on their level of maturity, interest in products, budget, etc., in order to qualify leads and direct them to sales teams according to their score.

On the contrary, customer scoring is used throughout a customer's lifecycle and allows the marketing team to retain existing customers while promoting upsell and maximizing LTV.

How to build a customer scoring model?

Customer scoring involves ranking customers according to their interest in the offers proposed, their buying behavior, or their willingness to respond positively to solicitations. The scoring criteria, which can include socio-demographic, psychological, behavioral, and consumption data, vary from one company to another and must be aligned with its specific objectives.

Different methods exist for calculating customer scores, relying on mathematical rules and weights attributed to different criteria. Among the standardized approaches is the RFM scoring, which assesses a customer's likelihood of purchase through three factors: Recency (date of last purchase), Frequency (number of purchases), and Monetary value (value of purchases).

To create a personalized scoring model, you must follow these 5 key steps:

Start by clearly defining the scoring objective and how it will be used.

Then carefully choose the scoring criteria, ensuring their relevance and reliability.

Make sure with your data team that your data used in scoring are available! It is essential to collect and centralize them in a single source of truth. For this, we recommend using a data warehouse like Customer 360.

Customer 360, centralising all customer data

Define the score calculation formula, including the mathematical rules and the weighting of the criteria. Once this is done, assign a score to each customer for each criterion and calculate the final score by applying the weighting.

Define the tiers that will be used in segmentation. For example, all customers between a score n and a score m will be included in the "Best customers" segment.

Establish and automate the appropriate marketing strategies for each group. For example, at-risk customers may receive personalized offers to limit the churn rate, loyal customers may be rewarded, dormant customers may be reactivated, etc.

After testing and validating this method, it is important to analyze the scores obtained to validate customer segmentation.

⚠️ In some cases, it is relevant to assign a score to a customer not on the scale of the company, but on the scale of products/services. This is particularly relevant when product/service offerings are significantly different from each other.

Some examples of scoring models

The RFM model: Recency, Frequency, Monetary

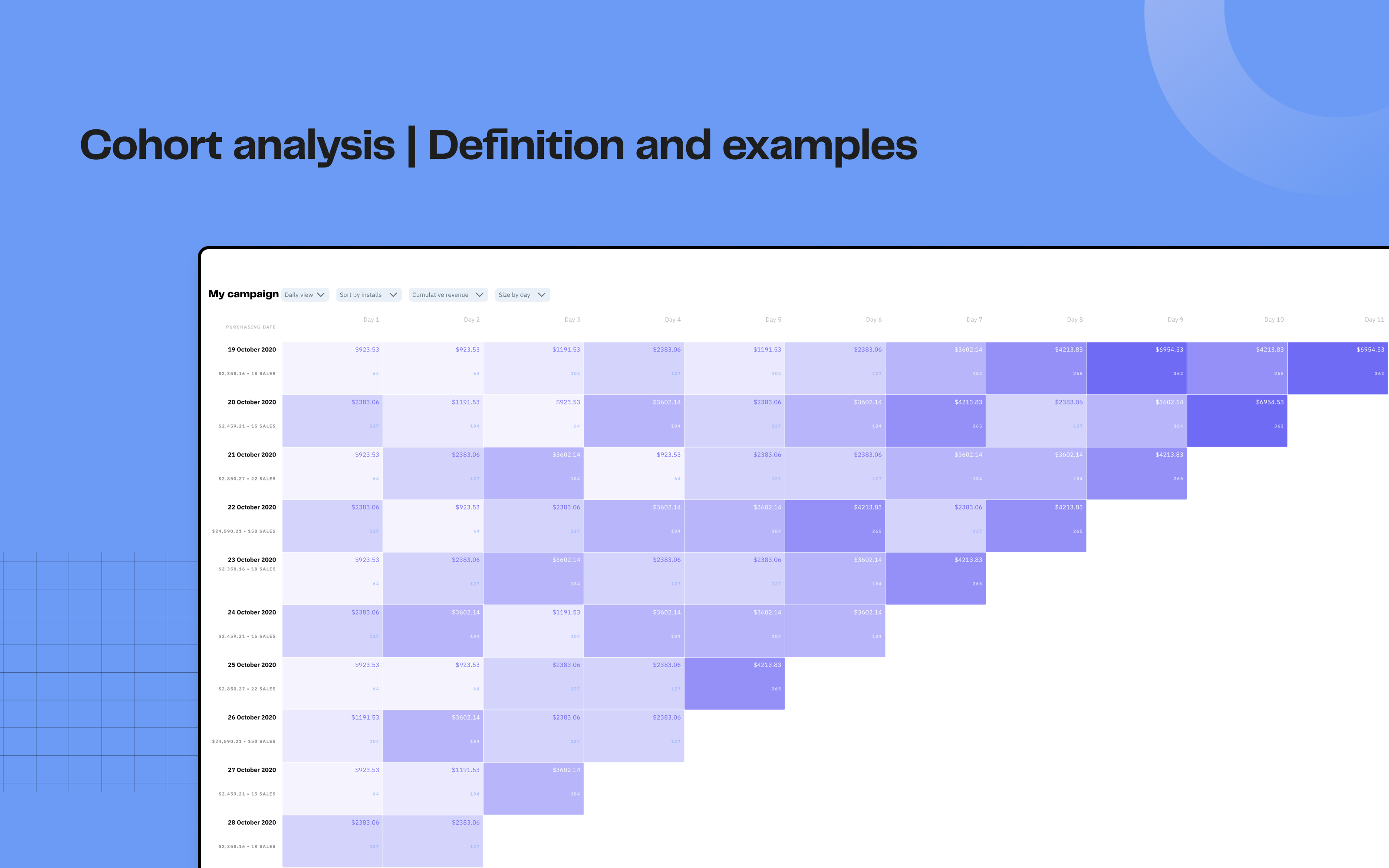

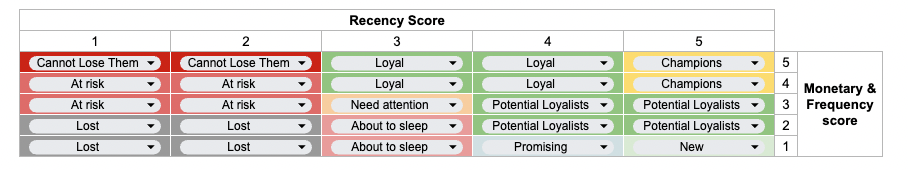

The RFM model is a widespread technique for customer scoring, appreciated for its ability to segment customers according to their buying behavior through three criteria: Recency, Frequency, and Monetary value. Each criterion is subdivided into classes, allowing the company to assign a 3-digit score to each customer.

For example, an RFM score of 555 signals a loyal customer, while a score of 111 indicates an inactive customer. The RFM model thus serves to categorize customers according to their value to the company and to determine targeted marketing strategies.

Example of RFM segmentation

💡 In reality, the RFM method can lead to different segmentations. Several segmentation methods have emerged: the 3x3 RFM segmentation of Analytics Vidhya, the RFM segmentation of Putler, or that of Barilliance are just a few examples. It's up to you to determine the right number of segments and the right "labels" depending on your context.

If you need a free template that explains RFM analysis and calculates values, scores and results with your customer data, you can use ours:

👇

RFM Download our ultimate guide to RFM segmentation

All you need to understand RFM segmentation + free template for automatically segmenting your customer base

Other scoring models

The RFM model is just one method among others for evaluating customers. Other approaches consider various criteria such as socio-demographic, psychological, or navigation data.

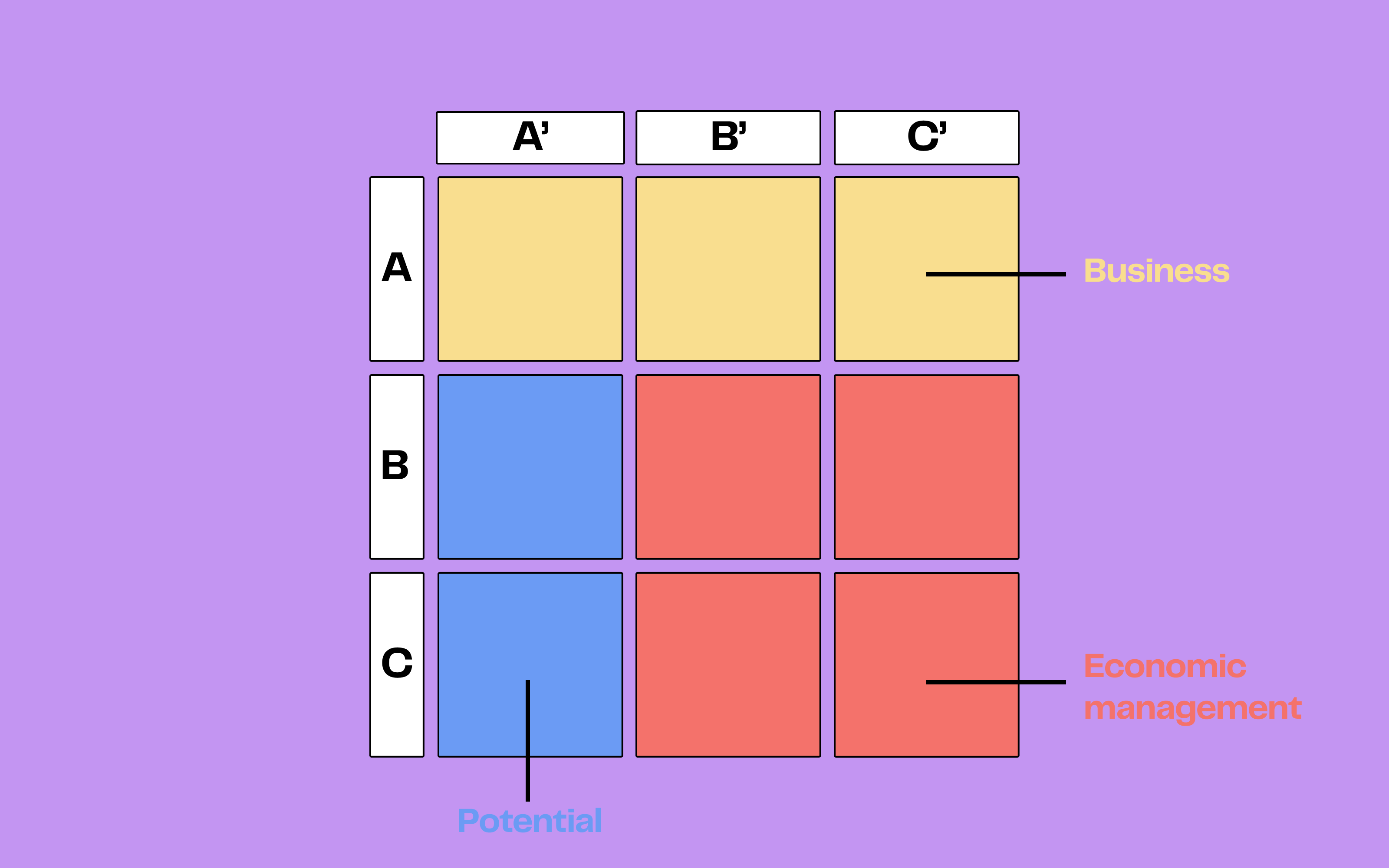

For example, the ABC analysis can be used to divide these customers into 3 main segments: those who are currently generating business, those who have potential and those on whom we should not devote too much time/resources.

In addition, the LTV model (Lifetime Value), for example, calculates a customer's future value based on their revenue, costs, and lifespan. The NPS model (Net Promoter Score), meanwhile, assesses a customer's satisfaction and loyalty. Each of these models has its advantages and limitations and can complement or compete with others depending on the specifics of each company.

The advantages and practical applications of customer scoring

Customer scoring offers substantial advantages to companies eager to refine their marketing and sales strategy. Thanks to customer scoring, it is possible to:

Better know your customers, by deciphering their characteristics, needs, expectations, and motivations.

Refine customer segmentation, by classifying them according to their score, profile, and potential.

Optimize customer targeting, by proposing tailor-made offers based on their score, interest, and probability of conversion.

Strengthen customer relationships for more loyalty, thanks to a personalized experience, adapted rewards, and timely solicitation.

Limit the risk of churn and reactivate passive customers to maximize sales. Customer reactivation campaigns are essential strategies for reigniting their interest and motivating new purchases.

Enhance customer promotion, encouraging existing customers to recommend the company.

Improve the profitability of marketing actions, by targeting high-potential customers, maximizing the return on investment of campaigns, and minimizing acquisition costs.

Thus, customer scoring proves to be a valuable decision-making tool, facilitating informed marketing and commercial decisions, based on the score of each individual.

How can DinMo help with calculating and using customer scoring?

At DinMo, our mission is to democratize access to data for all non-technical teams, whether they are Marketing, Sales, or Customer Success. In a world where everyone claims to be "data-driven," few companies actually analyze and correctly exploit their data. And yet, a huge growth potential is hidden there!

To help our clients, we enrich their prospect and customer data with predictive metrics (future LTV, risk of churn, etc.) and automatically calculate scorings according to their context.

Thanks to our Visual Builder tool, it is then possible to create customer segments based on the generated scorings. These segments can be activated later in any platform (advertising, emailing, CRM, etc.) using our Reverse ETL process and used to optimize marketing performance.

💡 A change in the scoring methodology or in the segments is automatically reflected across all platforms, ensuring a homogeneity of strategies in all tools. For example, you can automatically calculate your RFM scores and modify any criterion (recency, frequency, amount, the number of segments, etc.) whenever you wish. Everything will be automatically updated in the Audience Manager.

Conclusion

Customer scoring is an innovative method for evaluating each of your customers according to criteria defined by your sector. This approach provides a deep understanding of your clientele, favoring their segmentation and the development of tailor-made marketing strategies, in line with their profile and potential. Thus, customer scoring presents itself as a key resource for improving the return on investment (ROI) of your marketing campaigns and for strengthening customer loyalty.

Various methodologies, such as the RFM, LTV, NPS models, can be employed to calculate your customers' scores. It is essential to select or design a model that matches your specific ambitions. This selection also involves identifying relevant scoring criteria, choosing the appropriate calculation tools, and implementing targeted marketing actions.