In an highly competitive digital environment, the use of customer data in its marketing operations has become essential to stay competitive. Customer Data Platforms (CDPs) have been identified for several years as the “perfect” solution to collect, consolidate, centralise, analyse, segment and activate customer data.

Recently, the data marketing ecosystem has evolved towards more flexible and “à la carte” solutions; promoting “Composable CDPs”. A few players have emerged in this category, including Census.

What are the alternatives to Census, and what makes them different?

What is Census?

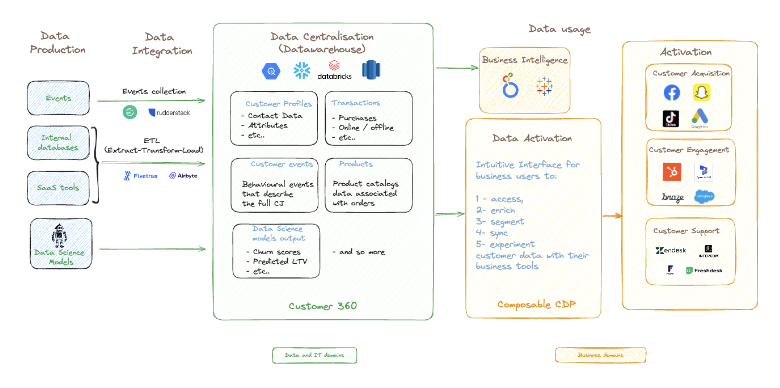

A brief definition of Composable CDP

A Composable CDP is a flexible solution that collects, models, and activates customer data from your existing data infrastructure. It leverages the customer data repository of a data warehouse. Rather than functioning as a separate entity, the Composable CDP integrates seamlessly into your Modern Data Stack, addressing all the disadvantages of traditional CDPs while covering the same use cases.

Schema of a Composable CDP

With a composable CDP, you can immediately put your data to use, crafting targeted campaigns across various channels. No more waiting for weeks—everything is prepped and ready for action.

A brief history of Census

Census, also known as GetCensus, is a Composable CDP that enables businesses to synchronise data from their warehouses to various business tools such as CRMs, advertising platforms, and marketing tools. Founded with the mission to help companies better utilise their data, Census focuses on eliminating data silos and providing a unified, trusted source of customer data.

Since its creation in 2018, Census has positioned itself as the ultimate Universal Data Platform. In May 2025, Census was acquired by Fivetran, which aims to offer a unified data movement platform, from data ingestion to activation.

The core of Census lies in its Reverse ETL technology, which makes it possible to pull data from a centralised data warehouse and distribute it in real-time to various applications across teams like marketing, sales, and product development. This approach helps businesses maintain a consistent and accurate view of customer data, improving decision-making and operational efficiency.

Census has gained traction with companies across industries, helping organisations like Canva, HubSpot, and Uber build personalised customer experiences and automate workflows without needing complex coding or engineering support.

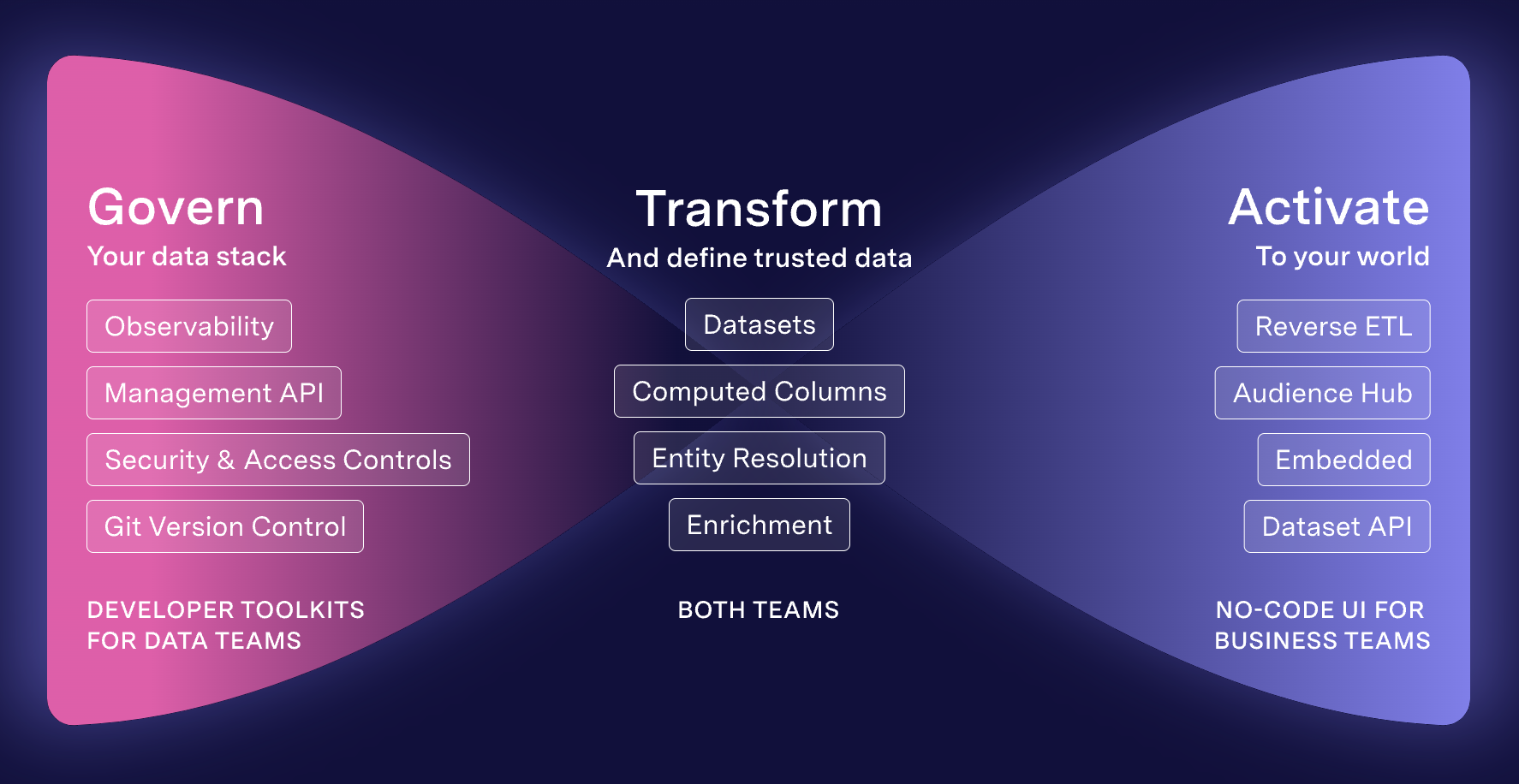

How does Census work?

To start using Census, you just have to connect a source that centralises all your customer data (most often, a data warehouse). Originally, Census did not collect data. The solution focused on managing the data infrastructure by offering improved observability, simplified API management, enhanced security, and Git-based version control.

Census allows you to create a 360° view of your customers, notably thanks to its identity and entity resolution capabilities. This customer view is directly actionable thanks to Census’s two flagship products:

Audience Hub: A suite of no-code features that allow you to build audiences and orchestrate campaigns

Reverse ETL: An activation platform that lets you sync your customer data with any destination (marketing, support, operations, etc.)

Credit: Census

Note that Census additionally offers several products to improve data and business operations:

Live syncs: A real-time Reverse ETL to cover specific use cases, including on-site personalisation

Embedded: A solution that allows data sharing with external clients and partners. The main objective is to enrich your data base with third-party data, to boost signals and matching rate.

It's also worth noting that Census ensures the security and governance of your data, maintaining it within your existing infrastructure (most ot the time, your data warehouse) for optimal control and compliance.

Alternatives to Census

👉🏼 In this article, we compare the best-known CDP solutions and look at their key differentiators so you can make an informed choice for your business.

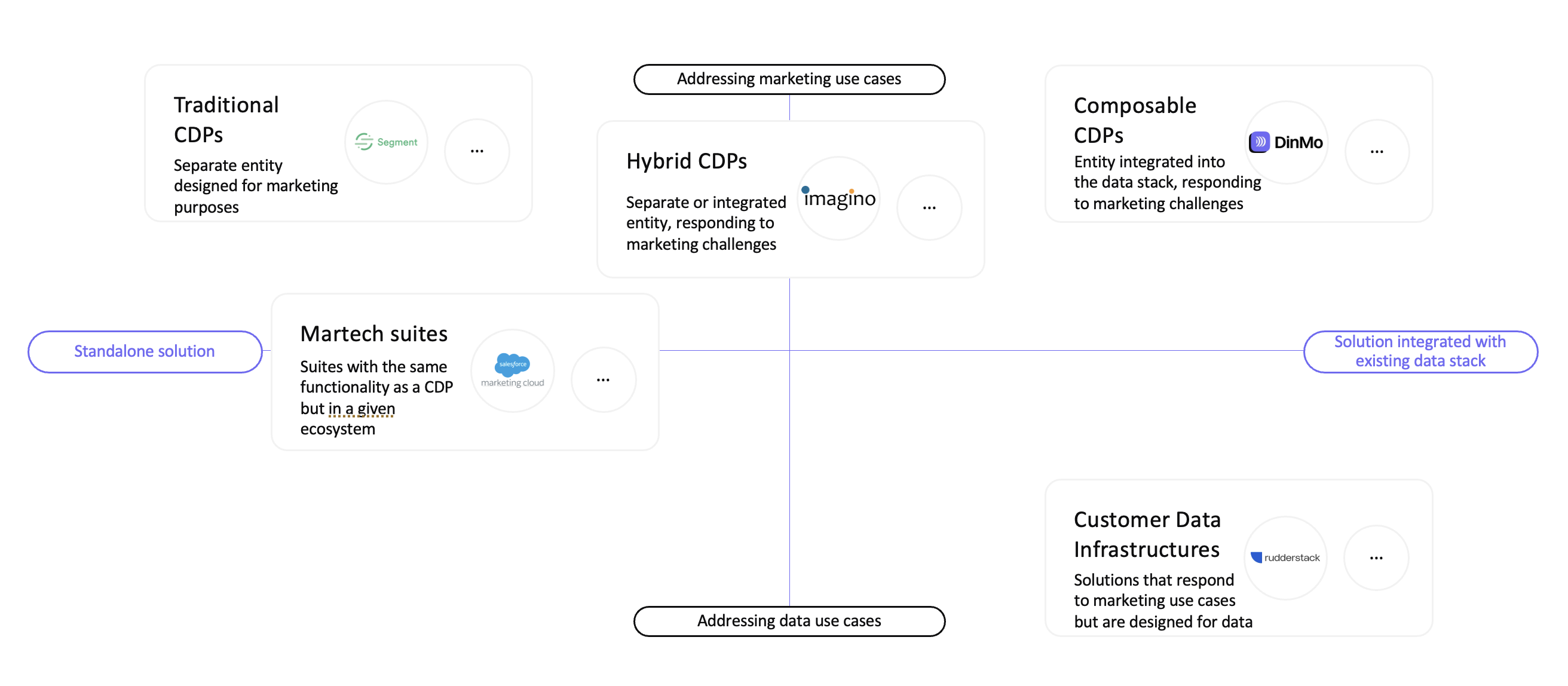

In the rest of the article, we detail the main competitors of Census, divided into different categories of CDP:

Composable CDPs, the closest alternative in terms of architecture

Infrastructure solutions, covering the full range of CDP use cases, but primarily aimed at data teams

Traditional CDPs

CRM suites

Categories of CDP

Disclaimer: Even if it's not Census, we recommend using a Composable CDP if you want to overcome the limitations of traditional CDPs:

More expensive: Non-composable solutions are more expensive in two ways. First, you pay for everything, whether you use it or not. Second, it’s so hard to change your solution that they can keep raising prices without losing customers.

No best-of-breed: When you use a non-composable solution, you’re accepting that some parts of your stack aren’t the best.

Slow to build new use cases: The process of integrating new data sources / types, if possible, is slow. It can take months and months to modify non-composable solutions.

Data duplication: When you use a traditional CDP, it has its own data base for your data to sit. But obviously, you’ll still need a company-wide data warehouse for all your other use cases.

Alternative #1: Other Composable CDPs

DinMo

DinMo is a Composable CDP that offers essentially the same features as Census:

A Reverse ETL engine to send data from a data warehouse to underlying marketing destinations, with real-time capabilities for specific use cases.

A “Customer Hub” product, a suite of no-code features that allow you to build audiences and orchestrate campaigns.

That said, DinMo outperforms Census with its non-technical features (user-friendly interface, no-code segment builder, etc.), available for all pricing plans. Designed first and foremost for business teams, DinMo is more user-friendly for marketers, bringing it closer to the interfaces of traditional CDPs.

Indeed, Census "Audience Hub" is only available in the "Enterprise" plans, becoming rapidly expensive for marketing teams if they want to cover their use cases independently. Their reverse ETL is highly technical, requiring knowledge of SQL and the underlying APIs.

Additionally, DinMo differentiates itself with its artificial intelligence and machine learning capabilities, enriching its 360° view available in the Customer Hub with predictive attributes (LTV, Churn, etc.)

If you'd like to find out more about the differences between DinMo and Census, don't hesitate to download our comparison!

👇

Key differences between Census and DinMo

Hightouch

At the beginning, Hightouch was a Reverse ETL, only designed for data teams. Over time, Hightouch has developed and now addresses both data teams needs (automating their data flows) and marketing teams needs (covering all marketing use cases). Hightouch has managed to capture significant attention as the Composable CDP of many leading businesses seeking top-notch data management solutions.

Like Census, Hightouch offers features that cover all CDP use cases (data collection, identity resolution, Reverse ETL, “Customer Stuoio” etc.). Their pricing models are quite similar and the capabilities/performance of each are at the same level.

However, Hightouch has expanded to a new set of AI features, allowing marketing teams to test and optimise strategies faster with AI.

Alternative #2: Data Infrastructure Solutions

Treasure Data

Originally launched as a Big Data platform, Treasure Data pivoted toward CDPs after noticing that most of its use cases were for marketing teams.

To meet these needs, they developed features for aggregation, segmentation, and audience activation.

Despite this shift, Treasure Data remains a technical solution for data management, requiring technical skills and data engineering for implementation and maintenance. As a result, it remains more challenging to use than Census.

Moreover, Treasure Data doesn't integrate smoothly with a company's existing data infrastructure and duplicates data on its platform, raising data security and governance issues.

That said, Treasure Data boasts advanced features in analytics and machine learning (particularly for predictive applications).

RudderStack

RudderStack provides a specialised infrastructure for collecting, processing, and storing customer data through its suite of products (collection, Reverse ETL, identity resolution, etc.). It covers many of the same use cases as Census and Traditional CDPs.

However, RudderStack is solely focused on building and maintaining a customer data infrastructure (CDI) and doesn’t focus on the marketing persona at all. Although RudderStack can handle traditional CDP use cases, it may be challenging for marketing teams to use autonomously (as it requires code, APIs knowledge).

💡 If your focus is on data activation only, Reverse ETL solutions may be a good fit. These allow sent data from a data warehouse to destinations without extra layers (Customer Studio, identity resolution, etc.). Popular solutions like Grouparoo or Rivery offer general Reverse ETL capabilities.

Composable CDP solutions (Census, DinMo, Hightouch) also allow the option to purchase just the Reverse ETL product.

Alternative #3: Traditional CDPs

This group includes the traditonal players in the CDP market. Having been around for several years, these CDPs often have highly advanced features and cover the full range of Census’s functionality, sometimes even including AI capabilities.

Twilio Segment

Segment gained early recognition for its event tracking capabilities, offering SDKs for companies to track customer behaviour on their websites and applications.

Over time, additional features were added, transforming it into a full-fledged CDP: a "Connections" module for data transfers, an identity resolution module, and most notably, "Twilio Engage," which focuses on audience-based customer engagement.

Census and Segment have similar features, but the key difference is in data storage: Census keeps data within your infrastructure, while Segment stores it in a separate external database.

mParticle

mParticle is another traditional CDP, initially specialised in mobile event collection. It now offers a full range of CDP features: collection, storage, audience management, personalisation, as well as real-time applications and predictive attributes via its "Cortex" product.

mParticle was designed as an alternative to Segment, and as such, shares many similarities. However, it generally offers more robust capabilities across the board.

⚠️ Both mParticle and Segment are primarily designed for technical users and may take time to be fully adopted by marketing teams.

ActionIQ

ActionIQ began as a traditional CDP, much like Segment or mParticle. However, as the demand for composable approaches (such as "data warehouse first") has grown, ActionIQ has reengineered its architecture to better integrate with data warehouses. Now, it presents itself as a “hybrid” solution, offering the flexibility to store data either with the vendor or directly in a data warehouse.

⚠️ The “Composable” solution is less mature than other Composable CDPs on the market.

Alternative #4: CRM Suites

Recognising the growth of the CDP market, many CRM and Marketing Automation platforms have started offering CDP modules.

These modules are typically less mature and offer fewer features compared to traditional CDPs. However, they allow for a quicker return on investment due to shorter implementation times, enabling deployment of initial use cases within a few weeks.

Keep in mind:

These solutions are often less effective in data security and governance.

Switching CRM or Marketing Automation tools would also mean switching CDPs, which can lead to a long and costly process.

They tend to be less mature, offering fewer effective features overall.

If you want to learn more about DinMo and its advantages over Census, feel free to contact us!