Churn rate: definition, calculation and strategies to reduce it

5 min • Last updated on Dec 16, 2025

Alexandra Augusti

Chief of Staff

The churn rate, a vital marketing metric, measures the loss of customers or subscribers over a specified period. This rate reflects a company's success in retaining customers and providing a quality experience over time. A high churn rate can negatively impact a company's revenue, profitability, and reputation.

In this article, we unveil the intricacies of the churn rate: its definition, how it's calculated, and audience strategies to reduce it. You'll learn how to enhance your customer relationship management, refine your products or services, and strengthen your position against competitors.

Definition

The churn rate indicates the percentage of customers who stop using or buying a product or service within a given time frame.

It reveals a company's ability to keep its customers satisfied and loyal. Retaining existing customers is often more cost-effective than acquiring new ones (consider calculating your break-even point to validate this assumption).

💡 A high churn rate can lead to detrimental effects on profitability and brand image (due to dissatisfied customers).

There are two types of churn rate:

Total: When a customer switches to a competitor and does not return.

Relative: When a customer stays within the same company but switches products or services. Although the customer isn't lost, monitoring this indicator is crucial because a change in plan can negatively impact a customer's lifetime value.

Prioritizing relative churn over total churn is beneficial for the company, as it maintains a relationship with the customer and offers alternatives that meet their needs.

The churn rate is a key performance indicator (KPI) that assesses the effectiveness of customer retention initiatives. It is typically calculated on a monthly basis, though this can vary by industry and the nature of the offering.

Monitoring the churn rate over the long term (or tracking the retention rate, which indicates the percentage of customers remaining engaged with the company over a set period) is recommended.

Calculating Churn Rate

Intermediate Calculations

Determining your company's churn rate requires gathering two critical pieces of information: the number of customers lost and the total number of customers during a specific period.

For some businesses, identifying the number of lost customers during a given period is straightforward. For subscription-based offerings, simply look at the cancellation or unsubscribe rate. However, many sectors find it challenging to determine whether a customer is truly lost or if their purchasing frequency has merely decreased.

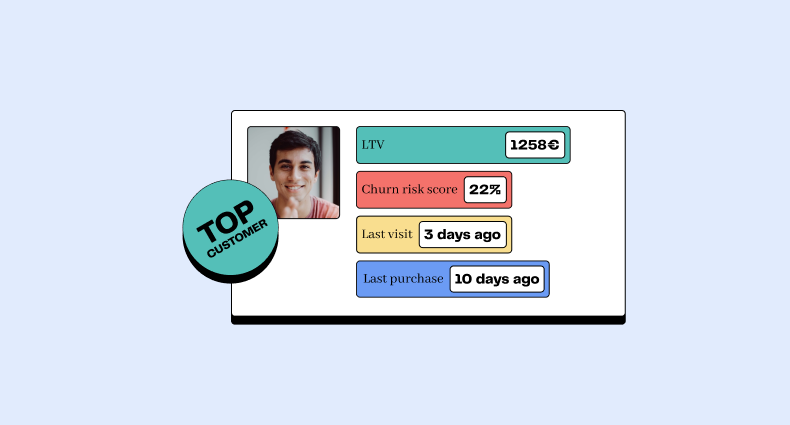

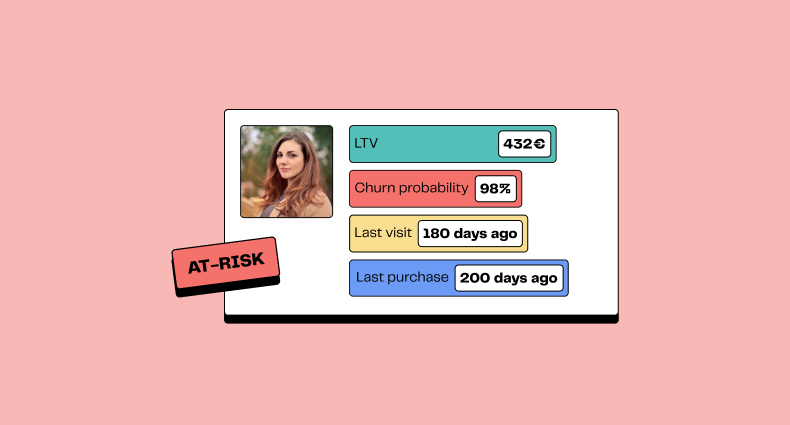

To estimate the number of lost customers, you can use your CRM to track and analyze standard purchasing data (such as through RFM analysis) and calculate the likelihood of repurchase. Customer satisfaction measures can also help assess the rate of lost customers.

Churn Calculation

To calculate the churn rate, divide the number of lost customers by the total number of customers at the start of the period (representing the churn), then multiply the result by 100 to convert it to a percentage.

Here's the simple formula to follow:

Churn Rate = (Number of Lost Customers / Total Number of Customers at the Start of the Period) × 100

👉🏼 For example, if you start with 1000 customers at the beginning of a month and lose 50 by the end, your monthly churn rate would be (50 / 1000) × 100 = 5%.

Note that the churn rate can vary by sector and depending on the services or products offered. Although it is often assessed monthly, the calculation can also be done on an annual basis or any other relevant period. It is advisable to track its evolution over the long term and compare it with the retention rate, the percentage of customers who remain loyal to the company during the observed period.

Retention Calculation

The retention rate is obtained by subtracting the churn rate from 100. Here's how to calculate it:

Retention Rate = 100 - Churn Rate

Therefore, if your monthly churn rate is 5%, the corresponding retention rate would be 100 - 5 = 95%.

The churn rate serves as a primary performance indicator (KPI) for evaluating the efficiency of your customer loyalty strategy. Regularly calculating and analyzing this indicator is crucial for understanding the reasons behind customer loss and developing appropriate corrective measures.

Calculating Customer Lifetime

Customer lifetime can also be calculated from the churn rate. To obtain this metric, simply divide 1 by the percentage of churn obtained.

Customer Lifetime = 1 / Churn Rate

For example, if your monthly churn rate is 5%, the customer lifetime is equal to 1 / 0.05 = 20 months.

Using the Churn Rate in Strategies

The churn rate is more than just a performance indicator; it is a strategic tool that can refine your customer relationship management, tailor your product or service offerings, and strengthen your market position. Reducing this rate helps retain customers, increase their long-term value, reduce the costs associated with acquiring new customers, and improve your brand image.

To effectively incorporate the churn rate into your strategies, start by comparing it to that of your competitors in your industry. This will allow you to determine if you are average, above, or below the norm. It is also crucial to track its evolution over time to identify less favorable moments and adjust your actions in response.

💡 Evaluating the churn rate for each customer segment is a fundamental step in refining your targeting and personalization, thereby optimizing your audience strategies.

Several strategies can be implemented to reduce the churn rate, depending on the reasons leading to it. The most effective include:

Improving the quality of your products or services, taking into account customer feedback, needs, and expectations.

Increasing customer satisfaction and loyalty through a positive, personalized, and multi-channel customer experience.

Predicting and preventing churn risks through predictive analyses and tailor-made retention programs.

Winning back lost customers by offering enticing deals, exclusive benefits, or personalized alternatives.

💡 It is advisable to calculate the churn rate for your different customer segments, especially if you offer a wide range of products or services catering to multiple personas. This allows you to tailor your marketing strategy to each customer segment.

In summary, the churn rate is a key indicator for measuring and improving the commercial performance of your company. Adopting an analytical and strategic approach to this indicator will enable you to invigorate your customer relationships, expand your product or service offerings, and solidify your competitive edge.

Conclusion

This article has guided you through the definition of the churn rate, calculation methods, and its strategic use. The churn rate, by measuring the loss of customers or subscribers, serves as a barometer of a company's ability to win customer loyalty and provide a quality experience.

A high rate signals major challenges that can negatively impact revenue, profitability, and company reputation.

To minimize the churn rate, it is essential to improve the quality of your offerings, strengthen customer satisfaction and loyalty, anticipate departure risks, and recover lost customers. Applying these strategies will optimize your customer relationships, your product or service range, and strengthen your competitive position.