Calculate and optimise your Customer Acquisition Cost (CAC)

6min • Last updated on Jan 22, 2026

Olivier Renard

Content & SEO Manager

Netflix pulled off an impressive turnaround. For the first time in its history, 2022 was marked by a significant drop in subscribers. A decline that was quickly reversed.

In 2023, the platform gained 30 million new subscribers, followed by 19 million in 2024, and a further 23 million in 2025. A success partly driven by a massive acquisition campaign focused on its new subscription offers.

Key Takeaways:

Customer Acquisition Cost (CAC) is a key performance indicator (KPI) that measures how much a company spends to acquire a new customer.

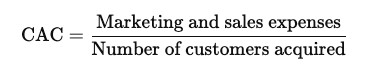

It’s calculated by dividing marketing and sales expenses by the number of new customers. Simpler or more detailed variations exist depending on the depth of analysis required.

There’s no such thing as a universal good CAC: it should always be interpreted within a specific context, depending on the sector, business model and long-term customer lifetime value (LTV).

A Customer Data Platform (CDP) helps optimise customer acquisition cost by leveraging all of the company’s data.

👉 Discover what CAC really means, how to calculate it accurately, and why it’s essential to steer your strategy. Follow our guidance to interpret it correctly and optimise it sustainably. 🎯

What is Customer Acquisition Cost?

Customer Acquisition Cost, or CAC, refers to the total amount a company spends to acquire a new customer.

It includes all marketing and sales-related expenses over a given period.

It’s a key performance indicator (KPI) used by businesses to measure the effectiveness of their efforts and improve profitability. It helps focus investment on the most profitable actions.

For example, let’s say you spend £20,000 this month on marketing and sales campaigns. If these efforts result in 100 new customers, then your acquisition cost is £200 per customer.

It’s a simple calculation that can also be broken down by channel (email, Google Ads, LinkedIn Ads, etc.) or by specific campaign. This allows for more granular analysis and fine-tuning of investment based on performance.

A strategic metric

Customer Acquisition Cost helps measure the effectiveness of marketing and sales activities. It shows whether the money spent on gaining new customers delivers sufficient return on investment (ROI).

It is especially useful for:

Assessing the profitability of a marketing or sales campaign.

Comparing acquisition channels and identifying the ones delivering the highest conversion at the lowest cost.

Steering the marketing budget more accurately by prioritising the most effective investments.

CAC should never be analysed in isolation. It must be considered alongside the revenue generated by newly acquired customers. It’s a decision-making tool that helps align spending with your company’s growth strategy.

👇

How DinMo helped Nexity reduce its CAC

How to calculate Customer Acquisition Cost?

Calculating CAC relies on a straightforward formula:

Customer acquisition cost calculation

The goal is to calculate the total cost needed to attract and convert a group of new customers. This helps businesses assess the efficiency of their marketing and sales investments.

What to include in your CAC calculation?

You can calculate CAC in a more or less detailed way, depending on the objectives. Here are the key elements to consider.

Include:

Paid marketing campaigns (Google Ads, LinkedIn Ads, email campaigns, etc.)

Salaries of marketing and sales teams

Agency or external consultant fees

Tools used for acquisition (CRM, ad platforms, prospecting software)

Exclude costs that are not directly related to acquiring new customers:

Costs related to customer loyalty and retention efforts

General overheads (customer support, day-to-day operational costs)

This distinction is essential to obtain a reliable and actionable customer acquisition cost.

Examples of CAC calculation

1️⃣ A small B2C business

A small company spends £2,000 on social media ads and email marketing. It attracts 50 new customers in a month.

👉 CAC = £2,000 / 50 = £40

In other words, the average cost per new customer is £40.

2️⃣ A B2B SaaS company

A SaaS startup invests £60,000 over a quarter in Pay-Per-Click (PPC) campaigns, marketing automation tools, and sales team salaries. Thanks to the leads generated, it acquires 120 new customers during that period.

👉 CAC = £60,000 / 120 = £500

Clearly, CAC varies widely depending on business type, sales cycle, and acquisition channels.

Why compare CAC with Customer Lifetime Value (LTV)?

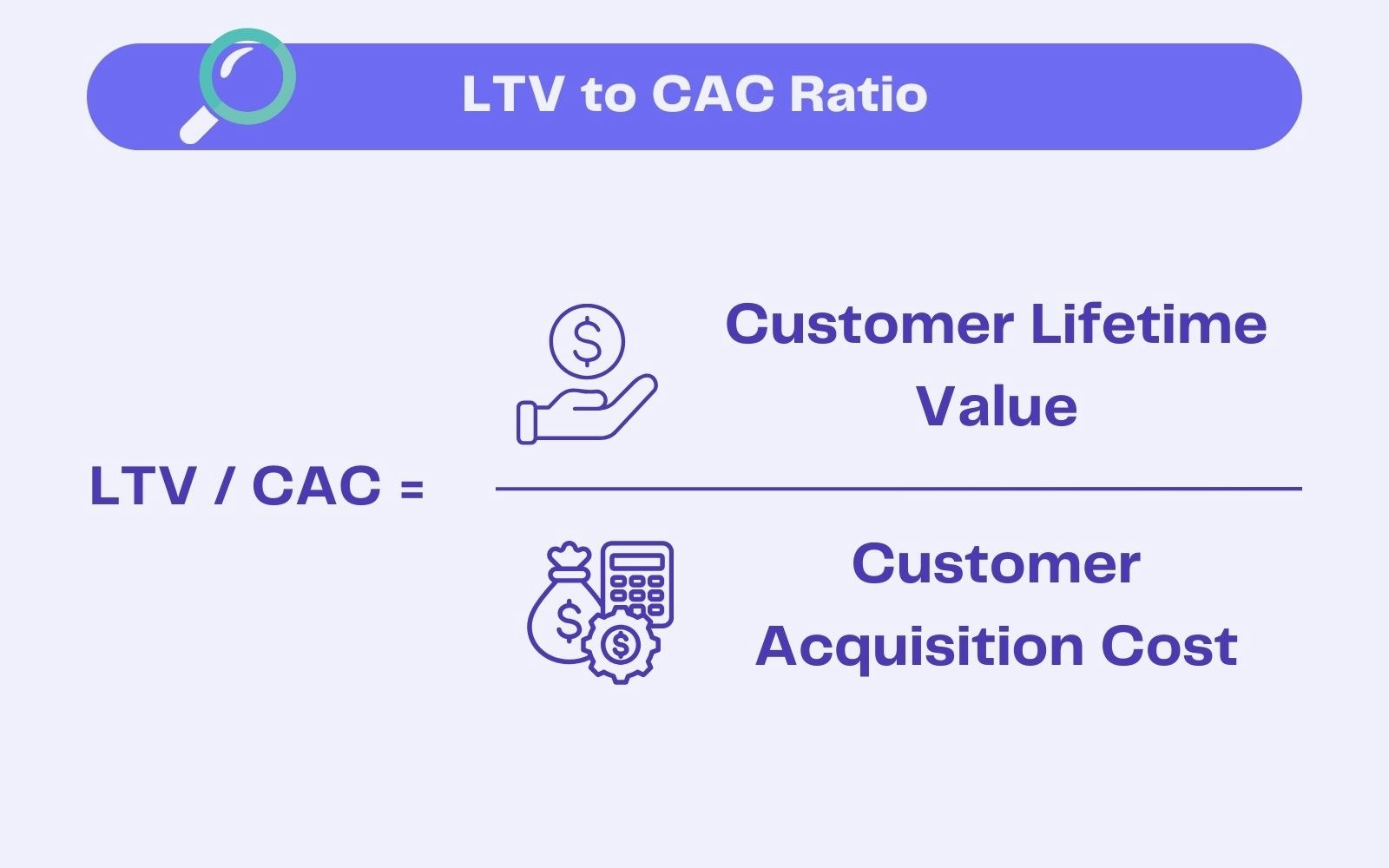

CAC alone doesn’t tell you whether acquiring a customer is profitable. It becomes meaningful when compared to the Customer Lifetime Value (LTV) — the total value a customer generates over the course of their relationship with the company.

👉 The LTV/CAC ratio helps determine the profitability of your acquisition strategy.

A ratio of 3:1 to 4:1 is generally considered healthy. This means that for every pound sterling spent on acquiring a customer, the company should generate £3 to £4 in return over the long term. Conversely, a ratio below 1 indicates that the revenue generated from these new customers is lower than the amount invested.

LTV to CAC ratio

Optimising your CAC

What factors influence Customer Acquisition Cost?

Customer acquisition cost can vary significantly from one company to another. This metric may rise or fall depending on several factors.

Length of the sales cycle: The longer it is, the more effort acquisition requires. This often involves multiple touchpoints, follow-ups from the sales team, and personalised support.

The cost per customer increases. A common situation in B2B or high-value sectors.

Resources involved: The salaries of marketing and sales teams are included in the CAC calculation. A strategy heavily reliant on manual prospecting usually results in a higher CAC than a more automated approach.

Quality of marketing targeting: Accurate targeting helps reach genuinely interested prospects. If a campaign targets too broad or poorly qualified an audience, the conversion rate drops and CAC rises.

On the other hand, precise segmentation and good lead scoring help focus efforts on the most profitable targets.

Acquisition channels used: Not all channels have the same acquisition cost or level of effectiveness. Content marketing (SEO, SMO) can generate lower-cost leads over the long term, while advertising platforms offer faster but more expensive results. Event-based or offline channels, meanwhile, often involve higher fixed costs.

Level of digital maturity: Companies with an advanced data culture have the tools to better measure, segment and optimise their actions. They can track conversion rates, identify the most effective campaigns, and react more quickly. The result: better-controlled CAC, based on real data.

DinMo composable CDP unifies your customer data to deliver a 360° Customer View. It enables precise audience segmentation and real-time personalised activation.

The result: more accurate targeting, more effective campaigns, and a better-controlled CAC.

How to reduce CAC?

Reducing customer acquisition cost doesn’t necessarily mean spending less. It’s primarily about optimising every £ invested. Here are the main levers to achieve this.

Improve conversion rates: Traffic is pointless if it doesn’t convert. Focus on UX, clarity of your sales funnel, and relevance of your messaging. A smoother journey means higher conversions, and naturally lower CAC.

Segment your audiences accurately: Reach the right person, at the right time, with the right message. Use your customer data to avoid broad, inefficient campaigns and increase ROI through better targeting.

Automate repetitive tasks: Syncing tools saves time and allows your teams to focus on high-value work. A Customer Data Platform simplifies the flow between data sources and destinations.

Focus on loyalty and referrals: Acquiring a new customer costs between 5 and 25 times more than retaining an existing one. Implementing loyalty or referral programmes helps generate additional customers at a lower cost. More importantly, these customers are often more engaged from the outset.

Measure and iterate continuously: Regularly track acquisition metrics, test new messages or channels, and adjust campaigns in real time. A test & learn approach is key to reducing CAC sustainably.

Best practices and common pitfalls

Best practices to adopt:

Track CAC regularly by channel and campaign, using appropriate tools (CRM, dashboards, multi-touch attribution, composable CDPs).

Test different approaches (formats, messages, audiences).

Cross-reference data for reliable multi-channel analysis.

Mistakes to avoid:

Including irrelevant costs, or conversely excluding necessary ones.

Ignoring the LTV/CAC ratio in your analysis.

Neglecting activation or onboarding phases, which affect overall profitability.

Conclusion

Customer Acquisition Cost (CAC) is far more than just a financial figure. It reflects the effectiveness of your efforts to win new customers.

It’s a true strategic lever to guide your marketing investments and prioritise actions. By optimising your CAC, you improve not only your profitability but also the overall performance of your acquisition strategy.

👉 Want to take control of your CAC using your customer data? Discover how DinMo can help.

FAQ

What should be included in a basic or detailed CAC calculation?

What should be included in a basic or detailed CAC calculation?

A basic CAC calculation includes marketing and sales expenses directly linked to acquisition, such as advertising campaigns or agency fees.

A more detailed calculation might also factor in team salaries, tools (CRM, automation), or content creation costs.

However, costs related to loyalty, customer support or product development should be excluded.

The right level of detail depends on your objective: high-level reporting or granular channel-by-channel analysis. What matters most is maintaining consistency in your method to track CAC evolution over time.

What’s the difference between CAC and Cost Per Lead (CPL)?

What’s the difference between CAC and Cost Per Lead (CPL)?

Customer Acquisition Cost (CAC) measures how much you spend to win a new customer.

Cost Per Lead (CPL) tells you how much it costs to generate a qualified contact (a prospect).

CAC is more comprehensive — it accounts for the entire journey up to conversion.

CPL sits earlier in the funnel and is often used to assess the effectiveness of lead generation campaigns.

In other words, a good CPL doesn’t guarantee a good CAC. It’s important to monitor both metrics to manage your marketing campaigns effectively.

Which tools should you use to monitor and optimise your CAC?

Which tools should you use to monitor and optimise your CAC?

Several tools can help you track your CAC over time.

A CRM can consolidate information on customer interactions and acquisition sources.

Marketing attribution tools such as Google Analytics help link spend to conversions.

A custom dashboard can also be created in a BI tool (like Looker or Tableau).

Finally, a Customer Data Platform (CDP) like DinMo allows you to unify your data and continuously optimise your acquisition cost.